Prescott, Ontario – A collision between two cargo trains in the heart of Prescott Thursday morning left one person injured and disrupted both rail and road traffic.

The collision on the main CN Rail line just west of Edward Street startled residents and workers with a loud bang shortly before 10:30 a.m., leaving two locomotives on their side near the town’s water tower and containers strewn across the immediate area.

In a statement, CN indicated four locomotives had derailed and approximately 16 cars had also “derailed in various positions.” It appeared that the damaged cars extended just east of the overpass. There was a minor fuel leak from one of the locomotives.

Ontario Provincial Police said one person was hurt.

“One individual only from incident with minor injuries,” the OPP reported via Twitter.

CN confirmed that one crew member was in stable condition; the other crew members were taken to hospital as a precaution.

CN’s mainline between Toronto and Montreal has effectively been blocked to all rail traffic, until the TSB investigation has concluded and the tracks can be cleared and repaired.

Asia-Europe facing ‘grim’ container peak season: shipper group

Greg Knowler, Senior Europe Editor

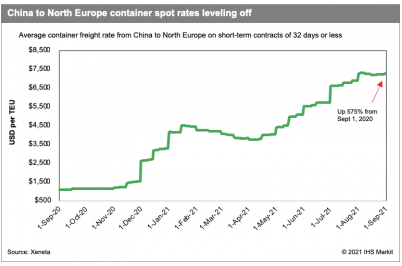

Peak season on the Asia-Europe trade is heading into an ever-worsening cycle of port delays, record rate levels, declining schedule reliability, and surges in volume that have overwhelmed the inland logistics system.

“Importers and exporters are facing a meltdown of the container shipping market, with rates in the stratosphere, slots up for auction, and service performance in the trash,” James Hookham, director of the Global Shippers’ Forum (GSF), said in a Container Shipping Market Review released Wednesday.

“The prospects for the coming peak season look grim,” Hookham added in the report, which GSF compiled with UK-based economist consultancy MDS Intermodal.

He said the significant effects of the Ever Given’s late-March grounding in the Suez Canal on schedules and port calls in Europe, North Africa, and North America were barely discernible through the second quarter with consistently rising rates, declining service, and ships sailing at close to their maximum capacity.

“What none of the industry metrics show are the huge numbers of shipments that are not being moved — the boxes left on the quay, stacked in the terminal, or stockpiled in export warehouses awaiting a slot,” Hookham noted. “Getting these goods to market will be the difference between economic recovery and empty shelves and consumer price inflation.”

A key factor behind the port congestion at North European hubs is the poor schedule reliability of the carriers. In July, Asia-North Europe on-time performance fell to 22.2 percent compared to 90 percent in July 2020, according to the latest data from Sea-Intelligence Maritime Analysis.

Patrik Berglund, CEO of rate benchmarking platform Xeneta, said landside infrastructure in Europe was being “simply overwhelmed,” with the congestion tying up vessels and their sought-after containers, in an ever-growing cycle of delays.

“With the holiday season logistical rush round the corner things may get worse before they get better, and that’ll have an obvious knock-on effect on rates,” he said in a Xeneta update this week.

“There’s still a dearth of equipment, high demand, and, worryingly, very congested ports that are choking up the supply chain for shippers and retailers,” Berglund said. “For example, in Europe, Maersk is advising customers of wait times up to 10 days at Antwerp, while Hapag-Lloyd reports that voyage delays have tripled in the first half of 2021 compared to the same period in 2020. A round trip between Asia and Europe now takes approximately 100 days to complete.”

According to the Xeneta Shipping Index (XSI), European imports rose by 0.5 percent in August, while exports climbed 3.4 percent, leaving the respective benchmarks up 123 percent and 49.1 percent year on year.

Carriers hold the cards

Average Asia-North Europe rates valid for 30 days or less this week were at $7,310 per TEU, an increase of 787 percent over the same week in pre-pandemic 2019, according to Xeneta. Average long-term contract rates of 90 days or more were up 226 percent on 2019 at $2,434 per TEU.

“While some may have been expecting an adjustment downwards, we’re seeing a further demonstration of the powerful position liner operators find themselves in,” Berglund noted. “They really are holding all the cards, and winning big.”

The market power of the carriers, apart from the record high profitability reported in the first half results, can be seen in the volume under their control. Alphaliner said in its latest weekly newsletter that the members of the three main alliances — 2M, Ocean Alliance, and THE Alliance — control 99.5 percent of all capacity on the Asia-Europe trade. The market share distribution is 36.2 percent for the Ocean Alliance, 36.1 percent for 2M, and 27.2 percent for THE Alliance.

The peak season traditionally ends at Golden Week from Oct. 1–7, a time when carriers traditionally blank capacity in anticipation of widespread factory closures across China. While there is no certainty that factories are planning to close over the period, or that demand will slow, Sea-Intelligence Maritime Analysis reported this week that Asia-North Europe carriers will withdraw 10.5 percent of the total weekly capacity during Golden Week. Carriers will cut 25.4 percent in the following week, followed by capacity withdrawals of 5.9 percent and 5.8 percent, respectively, during the two weeks after that.

“While the Golden Week plus 1 percentage capacity reduction may seem high, it is on the lower end when compared to the previous years,” Sea-Intelligence pointed out in its Sunday Spotlight. “All in all, 12 percent of the total capacity is slated to be blanked in 2021, which is lower than the historical average of 15 percent, and considerably lower than the 2019 and 2020 reductions of 18.8 percent and 20.6 percent.”

‘Big chaos’ coming as lack of air freight capacity will see peak season rates soar

Alex Lennane

Forwarders are predicting ‘big chaos’ and very high rates in the coming air peak season, as a host of issues combine, leading to demand significantly outstripping supply out of Asia.

The problems in Shanghai, where an outbreak of Covid has led to strict crew and quarantine rules for all airlines, and reduced manpower on the ground by about two-thirds, are expected to exacerbate the already bad situation.

The depleted workforce has led to a temporary ban on passenger freighters out of China, reducing already limited capacity, while charter approvals have been put on hold.

China Eastern is bringing back frequencies, but has its own ground handling at Shanghai, where a forwarder said: “No other airline has this advantage at the moment.

“There is a big question mark over whether most of those ‘preighters’ will be back in the coming weeks,” he added. “If nobody can handle the aircraft, or there are not enough crew, then airlines can do nothing but stop their schedules. It would be a huge issue, as preighters account for a big percentage of early air freight capacity.

“And it could be hard to get any new charter approvals. Without a large-enough workforce to handle more aircraft, I feel more than negative about the coming air freight rates, simply because the supply of capacity will be much less than the demand.

“If the situation is like this in the next few months, during a period of very peak time, we might see big chaos, even worse than last year. Both freighters and charters played a very important role in adding capacity last year, but both are constrained now.”

He said some smaller airports were still accepting charters, but added: “For this peak season, it’s more than tricky to charter any pure freighters, which are all contracted already.”

Several forwarders have noted that the big retailers and multinational forwarders were now operating scheduled charters.

“I believe more will do this in the coming months,” said one. It is common sense now. Large-volume shippers won’t be able to count on scheduled commercial flight capacity, and it is impossible to fix a steady price. But the question is whether they can find available aircraft, and an inland airport which can get enough manpower for handling.”

Rates are already on the up. In the past two weeks, rates from China to the US west coast rose to more than $10 per kg, while forwarders reported $11.50 to Chicago.

“But the worst is still to JFK, a direct service,” said a forwarder. “This week it is $12 to $13 per kg – not too far off the rates during the PPE period last year.”

High rates to the US have also disrupted capacity to Europe, said a Singapore forwarder.

“South-east Asia to the US … is increasing to double-digit figures. Certain airlines prioritise US-bound cargo instead of Europe-bound purely for the higher yield it offers. Hence, it may be easier to secure space for the US than Europe.

“Any form of rate stability is now gone, with carriers quoting rates on a shipment-by-shipment basis. Local origins do not have much control over the rates and HQ decides on the pricing.

“The capacity crunch is so severe that bigger shipments of cargo, in excess of 40cu metres, are very challenging to move from major [Asian] export airports.”

The Singapore-based forwarder explained that the South-east Asian market was suffering from manufacturing delays, adding to air freight demand as shippers try to speed up supply chains.

“Major export airports such as Hanoi, Ho Chi Minh, Phnom Penh and Bangkok are facing high demand for airfreight to both Europe and US destinations. Factors that are causing the increase in demand are due to production delays.

“The spread of the Covid-19 Delta variant in South-east Asian countries has caused significant disruption to manufacturing, and many buyers are having to airfreight their products to reduce the lead time it takes to get the stock to market.

“The instability of ocean freight has further exacerbated the problem, with ocean carriers facing port congestions at major transhipment ports leading to missed connections and increased transit times.”

He said that, while the Middle Eastern airlines were “traditionally strong players” in the South-east Asia to Europe markets, “the increase in demand has caught carriers by surprise, and capacity is strained, especially from their hubs to European destinations”.

He added: “Airlines have more demand than available capacity, and are offering the space to whoever will pay higher rates. The situation has become similar to ocean freight in the past few months.”

In Sri Lanka, forwarders also reported a cut in capacity.

“We have seen a very sharp increase in air demand out of Colombo during the last two weeks,” said one, noting that Etihad had cancelled its passenger freighters, while Qatar had pulled some flights “for operational and technical issues”, and a “few others”, including Turkish, had also cut flights. But with major retailers looking to move stock fast, “rates have sky-rocketed during the past week and transit times have been stretched by four to five days more than normal.”

He added: “The main airlines will increase capacity to take advantage of the opportunity – and all forwarders will be at their mercy when it comes to rates.”

According to the latest data from Clive Data Services, rates rose 112% from pre-Covid levels in August, following a local lockdown in Vietnam and the cargo handling problems at Shanghai.

Port congestion sapping major Asia-US ship capacity injection

Bill Mongelluzzo, Senior Editor

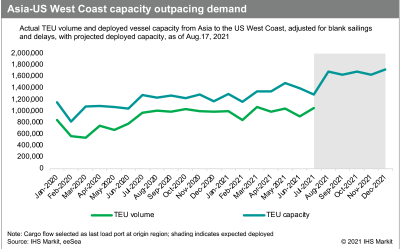

Container lines are increasing capacity on the Asia-US trades by double-digit percentages, but port congestion in Asia and the US is blunting the actual capacity available to shippers — keeping upward pressure on rates.

Container lines this month began upping their deployment of trans-Pacific capacity, with approximately 22 percent more capacity available to the West Coast through December than was available in March through July, according to eeSea, a platform that maps carrier schedules. Carriers are also adding approximately 14.4 percent more capacity to the East Coast through year-end, eeSea said.

Carriers in recent months have announced dozens of extra-loader vessel deployments and several new weekly services to meet surging demand by US consumers that is projected to remain strong through the end of the year. US imports from Asia increased 32.4 percent in the first seven months of the year over the same period last year, and 21.7 percent from pre-COVID-19 2019, according to PIERS, a JOC.com sister product within IHS Markit.

However, the double-digit increase in capacity is likely to further stress ports that are already contending with vessel bunching in the early days of peak shipping season. For example, there are 40-plus vessels at anchorage in Los Angeles-Long Beach awaiting space, while terminals each day are working about 30 container ships at berth, with more vessels scheduled to arrive daily, according to the Marine Exchange of Southern California.

The ports of Los Angeles and Long Beach provide an egregious example of vessel bunching, but other ports, including Oakland, the Northwest Seaport Alliance of Seattle and Tacoma, Savannah, and New York-New Jersey have contended with vessel bunching on and off over the past few months.

Alan Murphy, CEO of Sea-Intelligence Maritime Analysis, said the next three months will be difficult for ports and their severely taxed inland supply chains. “Within the coming months, carriers are aiming at what can at best be described as a capacity explosion on the trans-Pacific trade — good for a booming market, but [it] could lead to even worse congestion,” Murphy said in his Sunday Spotlight newsletter.

Deployed capacity sufficient to meet demand, on paper

Trans-Pacific carriers in March through July deployed 1.37 million TEU of capacity each month to the West Coast. Actual TEU carried averaged about 1 million TEU per month, according to PIERS. Carriers deployed an average of 661,268 TEU capacity per month to the East Coast during the same period, while TEU carried averaged 521,00 TEU per month.

On paper, carriers deployed sufficient capacity to handle the containerized imports from Asia, but glitches throughout the international supply chain reduced the effective capacity of the vessels being deployed. Vessels were delayed leaving some Asian load ports, including Yantian and Ningbo, because of terminal closures related to COVID-19 outbreaks. Once they reached US ports, vessel delays have ranged from several days to more than a week as the ships idled at anchor awaiting berthing space. For example, according to Monday’s Port of Los Angeles Signal, which is published daily, the current average anchorage time at the port is 7.6 days.

Vessel delays at a number of US ports are being caused by terminal congestion and chassis shortages at ports and inland rail hubs. Retailers project that August will set an all-time record for imports. The Global Port Tracker, published monthly by the National Retail Federation and Hackett Associates, projects near-record year-over-year monthly import volumes continuing through the end of the year.

Given the current level of congestion at major US gateways, the capacity increases of 22 percent to the West Coast and 14.4 percent to the East Coast through year-end portend elevated vessel bunching at the ports, congestion at marine terminals, and chassis shortages at ports and inland locations. The capacity gains will also put stress on the intermodal rail networks from both the West and East coasts as railroads continue to “meter” the volume of intermodal containers they move each week from the ports so as not to further congest their inland rail ramps.

“The deployment of more capacity will create a surge of cargo at the destinations, with the potential of making the congestion even worse,” Murphy said.